Introducing Construction Stajune Inc., where your dream home becomes a reality! Discover the ultimate destination for building, renovating, and modernizing homes across Canada. Our team of expert craftsmen ensures every project is executed with precision and finesse, guaranteeing a result that exceeds your expectations.

But that's not all—unlocking savings through renovation rebates has never been easier. Our specialized assistance takes the hassle out of applying for rebates in all Canadian regions, maximizing your savings and ensuring you get the most out of your investment.

Top 7 Home Renovation Rebates and Tax Credits for 2024

Every year, various federal, provincial, and municipal programs provide support to Ottawa homeowners for renovations and home upgrades.

However, many homeowners miss out on these opportunities. In the last two years, the Canadian government has introduced several new programs, including grants and loans, to incentivize homeowners to undertake energy-efficient renovations.

How can you make the most of these Canadian government homeowner programs?

To simplify the process, Renco Home Improvements has compiled a list of the top 7 tax credits and renovation incentives available in 2024. This list serves as a resource for Canadian, particularly Ottawa, homeowners to understand the current government incentives for home renovations. Be sure to review the details of each program below to determine your eligibility.

1) Home Energy Conservation (HEC) Program:

This program assists Ontario homeowners in enhancing the energy efficiency of their homes with incentives totaling $1600. Administered by Enbridge, the program covers various eligible upgrades such as appliances, HVAC systems, and home energy improvements.

If you're considering updating your furnace, renovating your basement, or improving HVAC efficiency, this program can help offset the costs.

Here's how to qualify for the incentive:

Step 1: Sign-Up

Visit the program's website and enter your postal code. After answering three questions, Enbridge will determine your eligibility. If eligible, they will direct you to contact a Registered Energy Advisor to discuss the HEC Program.

Step 2: Schedule Energy Pre-Audit

Your Registered Energy Advisor will arrange a pre-energy audit on your home. You'll be required to pay the upfront cost of the audit ($250) and receive a report on your home's energy efficiency along with renovation opportunities.

Step 3: Complete Home Energy Renovations

Undertake qualifying home renovations to improve energy efficiency. These may include furnace upgrades, better window sealing, new insulation, HVAC updates, and more. The minimum requirement is two qualifying updates and a 15% increase in efficiency.

Step 4: Schedule Energy Post-Audit

Once your updates are complete, schedule a post-audit with your energy advisor. This will incur an upfront cost ranging from $175 to $600. However, upon completion, if you achieve the required 15% increase in efficiency, the $5000 rebate will offset this cost.

Step 5: Receive Check in Mail

After the energy post-audit is complete, you will receive your rebate check in the mail.

For more information about this program, you can visit the Ontario Home Energy Conservation website.

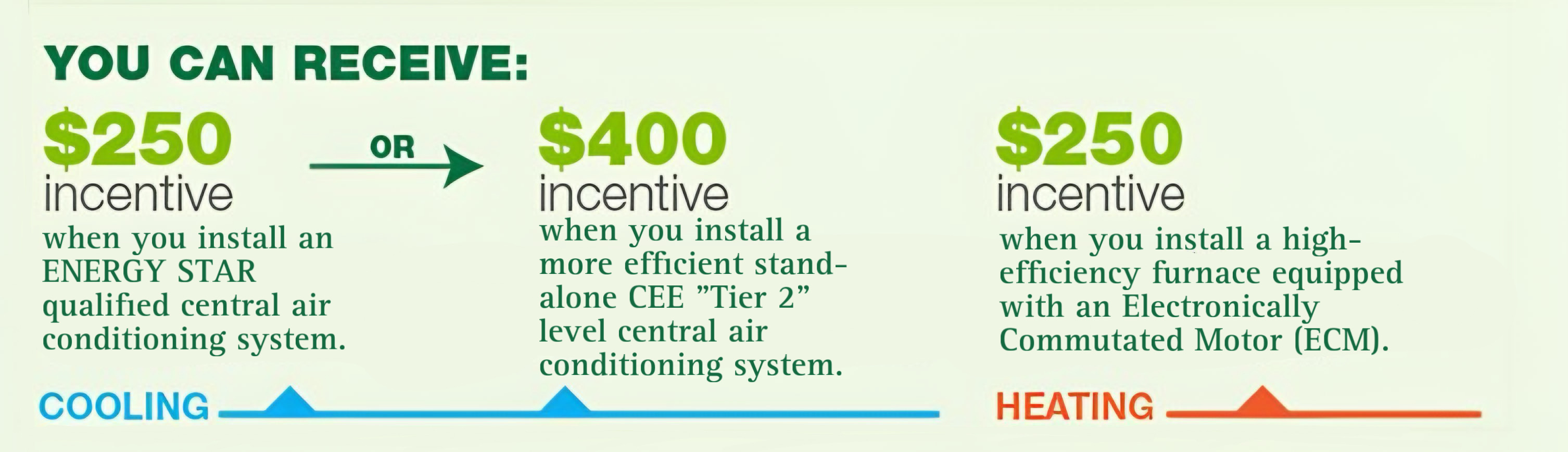

2) Save-on Energy Rebates

Similar to the HEC program, the Save on Energy conservation program offers rebates on the purchase of ENERGY STAR certified appliances, providing support to homeowners looking to upgrade their kitchen or basement and replace old inefficient appliances.

The rebate program offers various incentives with different rebate amounts for each appliance. For instance, refrigerators, washers, and freezers qualify for a $75 rebate, while larger HVAC upgrades like furnaces and heat pumps can provide rebates of up to $4,000.

How to Utilize the Save on Energy Program?

Ottawa homeowners can take advantage of the ENERGY STAR appliance rebate through the following steps:

Step 1: Visit the SAVE ON website

Explore the program details on the website, including eligible equipment and appliances for your home.

Step 2: Contact a SAVE ON energy advisor

Call 1-855-591-0877 or apply online at SaveOnEnergy.ca/EAP. An advisor will discuss your eligibility requirements, and depending on the outcome, you may receive either an 'Energy Saving Kit' or a visit from an energy expert to assess the upgrades that will benefit you the most.

Step 3: Audit and Incentives

Discuss your situation and intended upgrades with your Energy Advisor, who will provide information on available incentives and rebates. They will guide you on whether conducting an energy audit and taking advantage of the incentives makes sense for your situation. For full program details, visit the Save On Energy website. Incentives and rebates are subject to change for 2024.

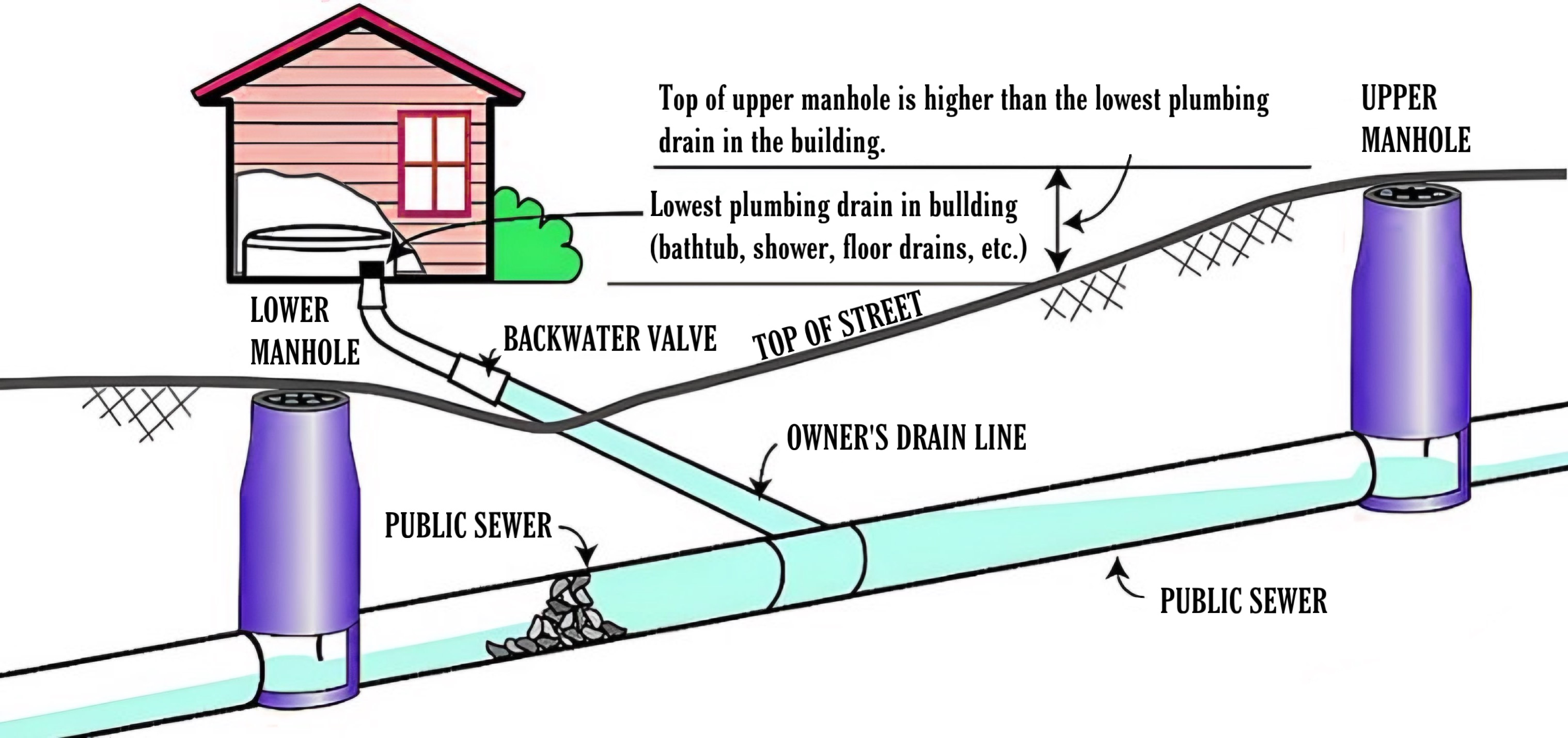

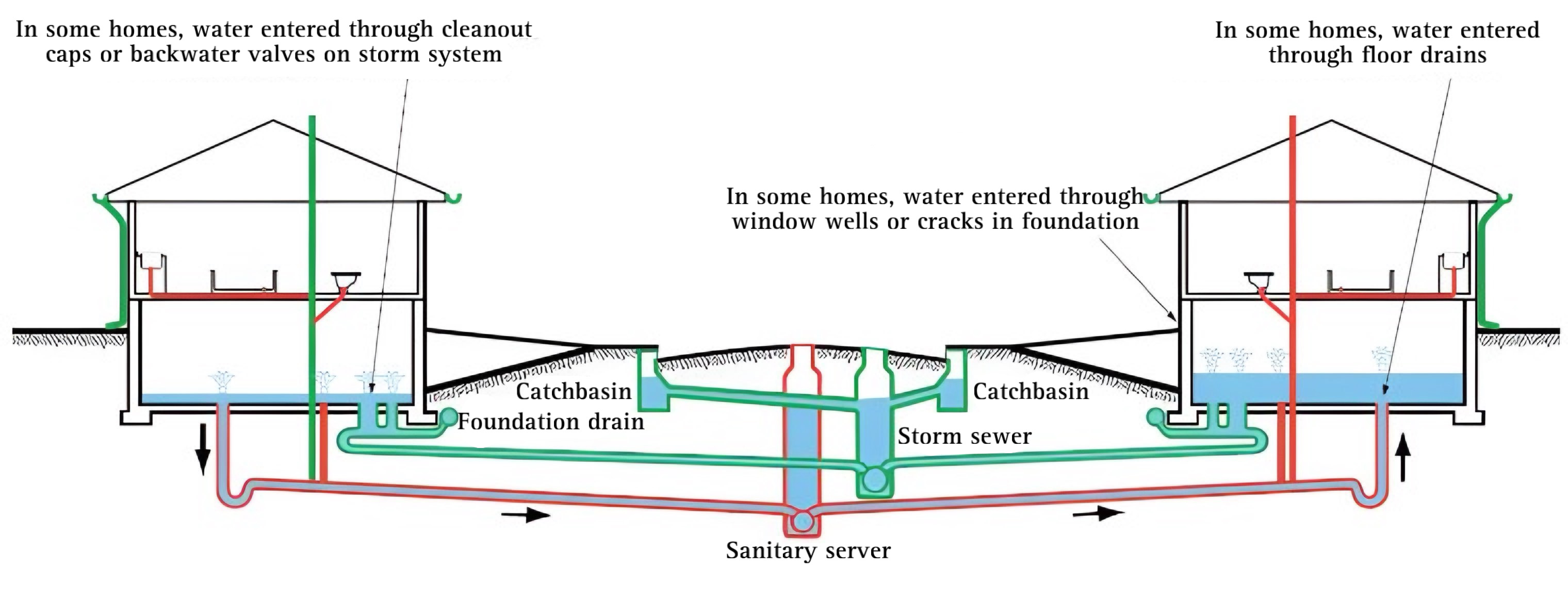

3) Residential Protective Plumbing Program (RPPP):

*Note: Exclusively for Ottawa homeowners*

In Ottawa, the unprecedented rainfall this year has caused significant issues for many homeowners' basements. However, proactive basement maintenance and understanding your home's plumbing infrastructure can help prevent most problems.

To assist with this, the City of Ottawa has established the Residential Protective Plumbing Program (RPPP), a municipal rebate initiative designed to aid homes susceptible to basement flooding.

The RPPP offers over $2,000 in rebates for basement flood prevention equipment, including backwater valve installation, sump pumps, and building permits for renovation activities.

Are you eligible for the RPPP program?

There are two primary eligibility requirements for Ottawa homeowners:

- Home built before January 1, 2004, for protective plumbing work related to private storm sewer services.

- Home built before January 1, 2012, for protective plumbing work related to private sanitary sewer services.

For further details on eligibility for the RPPP, please refer to the program's official guidelines.

How does the RPPP help protect your home from basement leaks?

The diagram below illustrates how water can infiltrate your basement through the city's sewer systems. Updating protective plumbing equipment, especially for homes built before 2004, is a prudent safety measure that may also reduce insurance costs.

How to take advantage of the RPPP Rebate?

Follow these seven steps to make use of the RPPP rebate:

1. Submit Your Application:

Visit the City of Ottawa’s RPPP website and follow the application instructions, including providing details of proposed work and a renovation quote.

2. City will review your RPPP application:

The city will review your application and contact you with any queries, next steps, and your assigned RPPP file number.

3. CCTV Inspection:

Your basement renovation contractor will conduct a CCTV inspection of the sewer lateral from inside the home to the city sewer at street level, and submit the recording to the City of Ottawa.

4. Site Visit:

The city will conduct a free site visit to confirm the necessity of protective plumbing.

5. Site Visit Review + Building Permits:

Following the site visit, you will receive a review. At this stage, your renovation contractor can apply for building permits and prepare for the proposed work.

6. Equipment Installation:

Your contractor can commence the installation of protective plumbing devices, foundation repair, and basement waterproofing, depending on your specific situation.

7. Rebate Processing:

After the completion of work and full payment, submit the final part of the RPPP application to receive your rebate check.

If you've experienced basement leaks, the RPPP could provide an opportunity to offset the costs of foundation repair and basement waterproofing, depending on your circumstances.

4) HST New Housing Rebate

If you're considering a major renovation, home addition, or transforming a non-residential property into a home, you may be entitled to a significant HST rebate of up to $30,000.

Of course, with such a substantial rebate, there are strict conditions and procedures to follow in order to qualify for the full rebate. Read on to determine if this program is suitable for you:

Who qualifies for the HST new housing rebate?

The Canada.ca website provides comprehensive eligibility details for the HST new housing program. If you're planning any of the following in Ontario, you may be eligible:

- Building a house

- Contracting someone to build a house

- Substantially renovating a house or condominium

- Contracting someone to extensively renovate a home or condo

- Adding a major addition to a home

- Rebuilding a home that was destroyed by fire

- Converting a non-residential property into a home

How to calculate the new housing HST rebate for home renovations?

The most accurate way to calculate your HST rebate amount is to visit the Canada.ca FAQ section on claiming your HST rebate. They provide various calculation worksheets tailored to different situations.

For instance, if you've hired a renovation contractor to construct a new home addition that doubles the living area in your house, you would qualify for the rebate. You can use the provided GST calculation form, which itemizes all expenditures, to determine the total amount.

How to apply for the HST housing rebate?

If homeowners are comfortable with filing their own taxes and navigating CRA forms, they can apply for the HST housing rebate independently. However, it's important to note that you can only apply for this program once.

If you're planning a major home renovation, such as adding an addition or completely renovating an old home, the HST housing program could be the right choice for you.

5) Home Accessibility Tax Credit (HATC):

The HATC is a non-refundable tax credit aimed at supporting seniors and individuals with disabilities by providing a rebate for mobility renovations in their homes, with qualifying expenses of up to $10,000. These renovations can include new ramps, bathroom modifications, elevators, stair lifts, and more.

Are you eligible for the home accessibility tax credit?

If you're 65 years or older or claim the disability tax credit, you qualify for the HATC program, which covers eligible renovations to your principal residence.

What qualifies as a home renovation for the HATC?

Permanent changes to your home, such as replacing a staircase with a ramp or installing an accessible bathroom on the main floor, qualify for the HATC.

How to Access: Visit the HATC program website for more information.

6) Home Appliance Tax Credit

In 2021, the Liberal government introduced a 15% tax credit to cover the expenses of home appliance repairs. The primary aim of this program is to reduce the number of appliances ending up in landfills and to assist homeowners when significant appliances require repair.

The tax credit can cover expenses up to $500 and was introduced in 2022, remaining active to date.

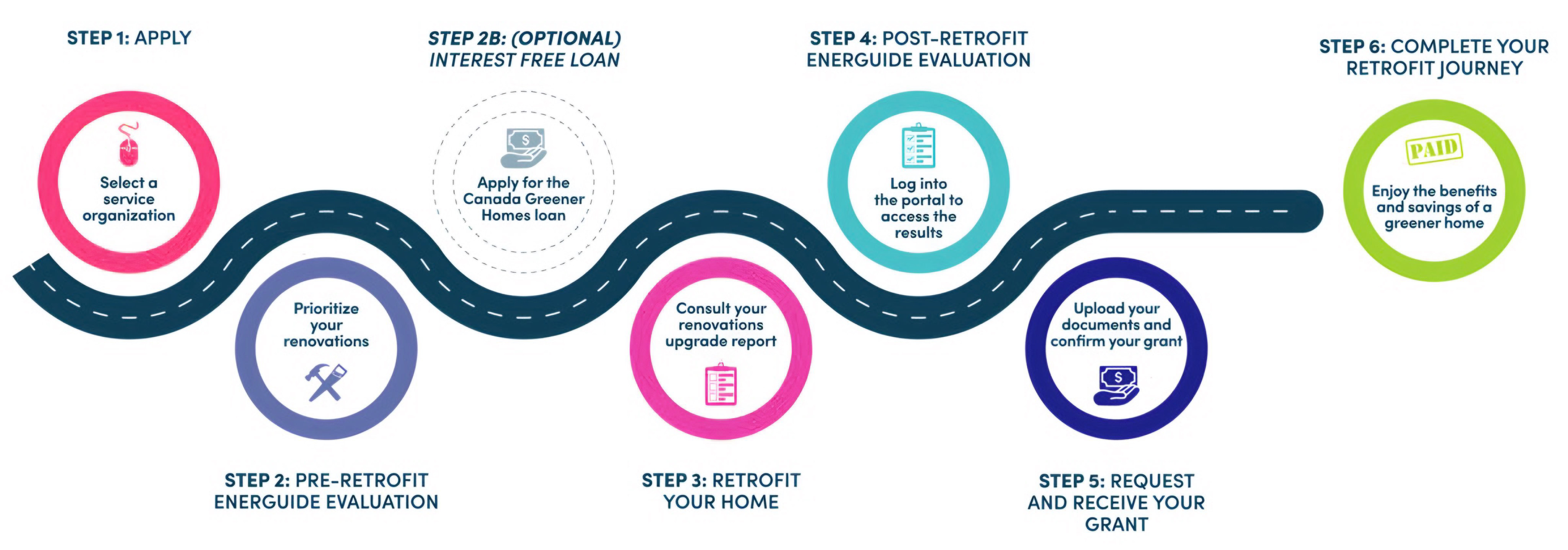

7) Canada Greener Homes Grant and Loan Programs:

Are you interested in upgrading your home to enhance its energy efficiency and reduce energy costs? The Canada "Greener Homes" program offers financial support for such endeavors.

As of February 2024, the Greener Home Grant is closed to new applicants, but the Green Homes Loan remains available.

This program comprises two parts:

- Grant: Provides up to $5000 for home retrofits.

- Loan: Offers an interest-free loan of up to $40,000 for retrofits.

Where to Apply: Visit the program website for further details.